mississippi income tax brackets

Mississippi Governor Tate Reeves R in his budget proposal for fiscal year FY 2022 has announced his goal of phasing out the states income tax by 2030. The graduated income tax rate is.

States With The Highest Lowest Tax Rates

Any income over 10000 would be taxes at the highest rate of 5.

. The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. Single tax brackets generally result in higher taxes when compared with taxpayers with the same income filing as Married Filing Jointly or Head of Household. For single taxpayers living and.

This is because the Single filing. The top bracket is for employees making more than 10000 per year. Mississippi Code at Lexis Publishing Income Tax Laws Title 27 Chapter 7.

This page contains references to specific Mississippi tax tables allowances and thresholds with links to supporting Mississippi tax calculators and Mississippi Salary calculator tools. All other income tax returns P. Because the income threshold for the top bracket is quite low.

On April 5 2022 Governor Tate Reeves signed into law House Bill 531 which provides the largest individual income tax cut in the states history by eliminating the current 4 tax bracket in 2023. Tax Bracket Tax Rate. We can also see the progressive nature of Mississippi state income tax rates from the lowest MS tax rate bracket of 0 to the highest MS tax rate bracket of 5.

Box 23050 Jackson MS 39225-3050. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. There is no tax schedule for Mississippi income taxes.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Mississippis income tax brackets were last changed three years prior to 2019 for tax year 2016 and the tax rates have not been changed since at least 2001. Each marginal rate only applies to earnings within.

These rates are the same for individuals and businesses. For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent. The latest available tax rates are.

Detailed Mississippi state income tax rates and brackets are available on. 0 on the first 2000 of taxable income. Married taxpayers must make more than 16600 plus 1500 for each qualifying.

Mississippi does not have additional municipal. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Detailed Mississippi state income tax rates and brackets are available on.

If youre married filing taxes jointly theres a tax rate of 3 from 4000. This means that these brackets applied to all income earned in. Mississippi has three income tax brackets ranging from 0 to 5.

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Creating Racially And Economically Equitable Tax Policy In The South Itep

Mississippi Tax Rate H R Block

Mississippi Sales Tax Calculator And Local Rates 2021 Wise

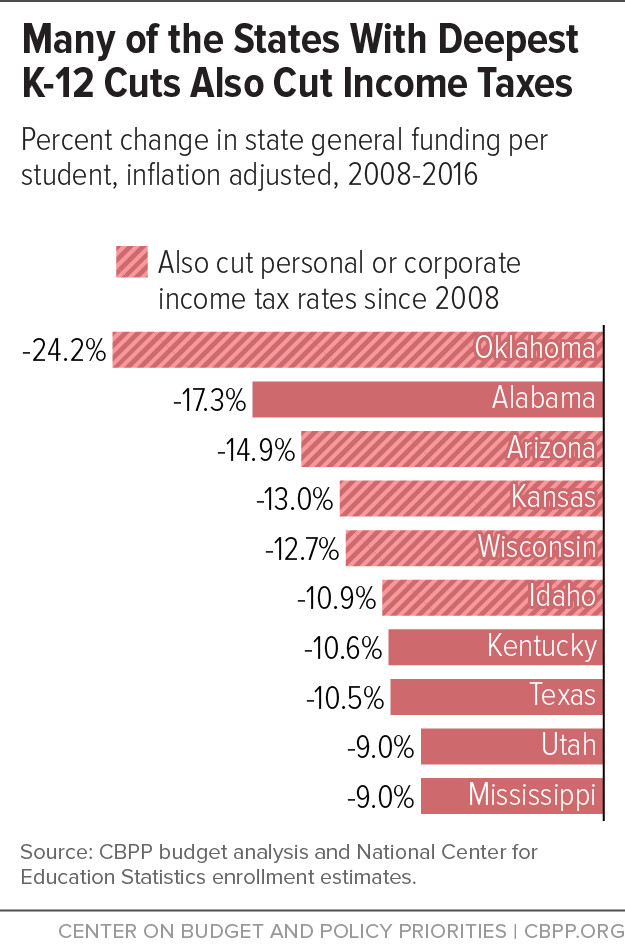

Mississippi Tax Cuts Would Worsen Education Squeeze Center On Budget And Policy Priorities

How Do State And Local Sales Taxes Work Tax Policy Center

Tennessee 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Vermont S Effective Income Tax Rate Dropped In 2010 Public Assets Institute

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Tennessee Exempted Taxes On Food Mississippi Exempted Taxes On Guns Mississippi Today

2019 Schedule Example Student Financial Aid

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Brackets And Rates 2022 Tax Rate Info

Top Income Tax Rate Dips To 5 9 Arkansas Democrat Gazette Nw 1 1 2021

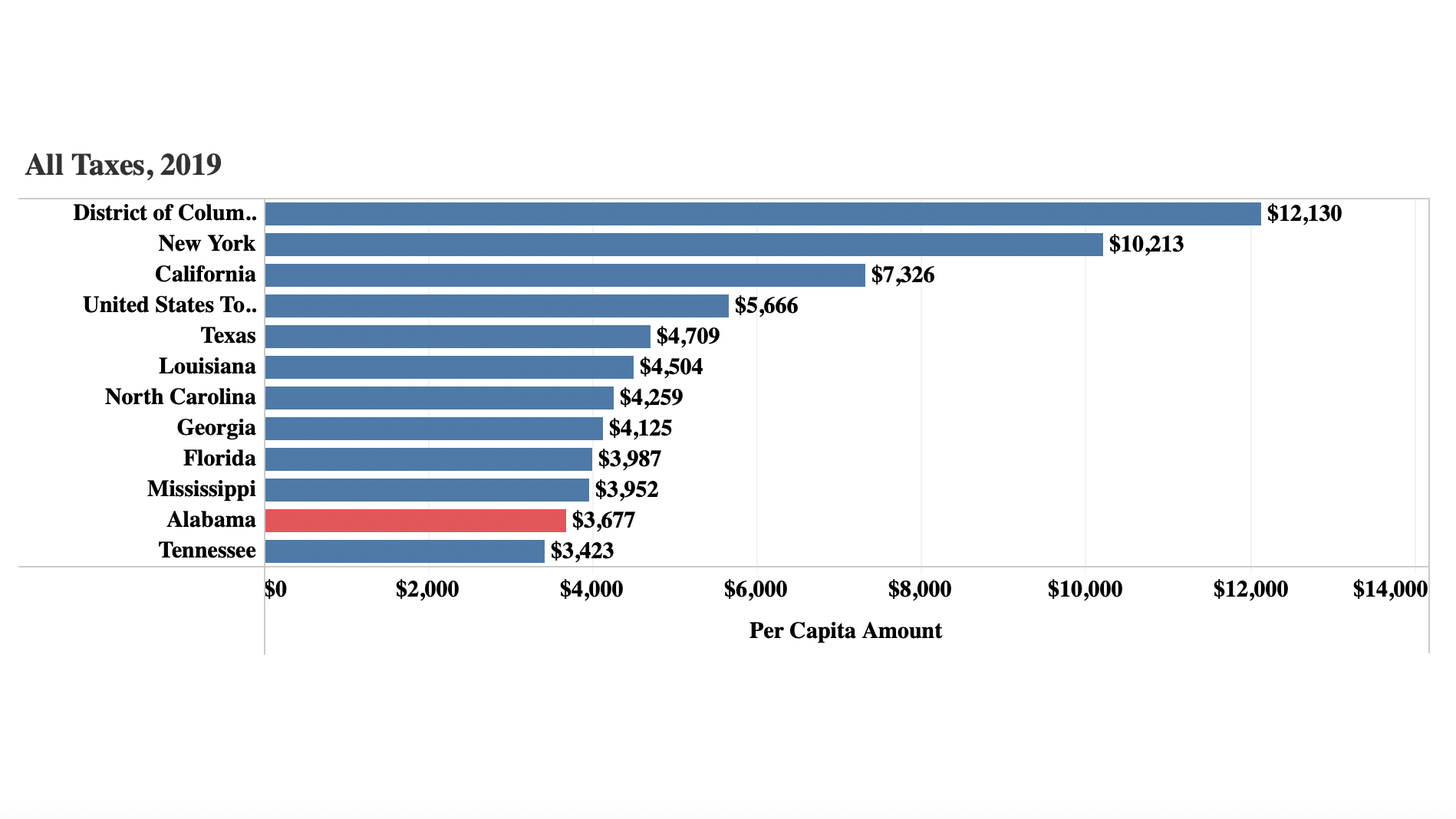

Parca Report Shows Alabama Has Nation S Second Lowest Tax Collection Per Capita

Strengthening Mississippi S Income Tax Hope Policy Institute

Mississippi State Tax Tables 2022 Us Icalculator

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute